FAMGA stocks have taken the world by storm today. FAMGA stands for Facebook, Apple, Microsoft, Google, and Amazon.

Who is their competition?

Plenty of companies globally manufacture smartphones, laptops, and other gadgets. But how many of them can claim to be in competition with Apple?

The internet is filled with online platforms that function as search engines. But how many of them can compete with Google?

Many e-commerce companies are micro-competitors of Amazon. But how many companies can take on the e-commerce giant by themselves?

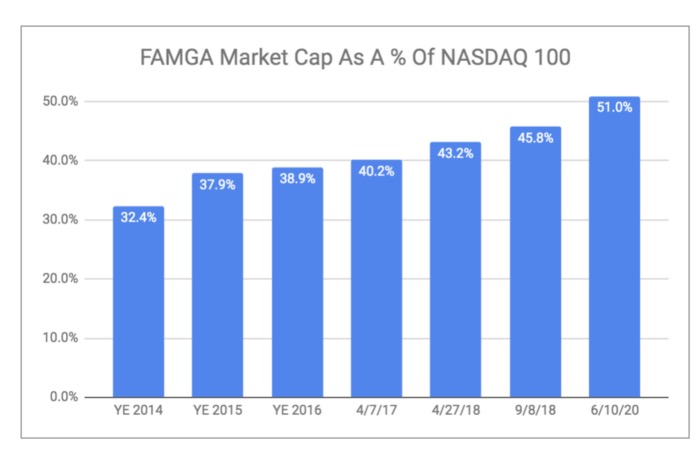

FAMGA companies have little or no competition, which is reflected in their valuation. These companies accounted for over 50% of the NASDAQ 100’s total market cap as of July 2020.

What led to these companies and others like Tesla and Zoom to leave their competition in the dust?

In my mind, companies that can escape competition do three things diligently.

1. They think long-term.

“If everything you do needs to work on a three-year time horizon, then you’re competing against a lot of people. But if you’re willing to invest on a seven-year time horizon, you’re now competing against a fraction of those people, because very few companies are willing to do that.” – Jeff Bezos

The majority of the market has always revolved around the short term: the current month or quarter, or at best, the current year.

Shareholders, venture capitalists, and analysts obsess with quarterly performance. The remuneration of top executives in many companies gets tied to the annual performance at best, which discourages them from thinking five to ten years ahead.

Such a limited view that the majority of the market holds presents long-term thinking companies with a powerful tool to escape the competition. They can spot and pursue opportunities early, create differentiation that customers are willing to pay for, and build assets almost impossible to replicate that turn into their moats.

Long-term thinking demands taking decisions that don’t pay off in the short-term. They might even appear foolish. When Reliance launched Jio, its free offering of service upset investors and analysts. When Amazon purchased Kiva Systems, analysts wrote it off the move as a poor decision.

But like the Chinese bamboo tree that shows no visible growth above the ground for four years and suddenly grows to 80 feet within 6 weeks of the fifth year, the results of Amazon’s and Reliance’s strategies compounded in the long-term. They left not just the competition but the entire market shocked.

Build the ability to think long-term and withstand pain today. You’ll reap amazing rewards in the future.

Rome took years to get built. Any artist or athlete will tell you that it takes ten years to get remarkable at something. Likewise, any good business takes at least five years to bear fruit. Short term-ism can only cause pain.

2. They build ecosystems where everyone wins.

In today’s hypercompetitive world, it’s impossible to sustain on the back of a single product or service. The companies that thrive do so on the foundation of ecosystems.

Google is not just a search engine; it’s an ecosystem of email, maps, mobile phones, storage, calls, and more. Reliance Jio has built a broad ecosystem by offering a plethora of amenities on its platform.

Further, such companies embrace the philosophy of prioritizing their partners’ victory before their own. This might appear like a losing strategy in the short term. But in the long term, it assures their own victory and growth too.

For instance, Pidilite teaches carpenters to read interior design drawings, use new electric tools, and more. It also holds sessions at schools to unleash creativity among children and in the process, strengthens its brand in their and their parents’ minds. Amazon conducts workshops for MSMEs to sell their products online and also export them.

At SME Value Advisors, we do our best to integrate this philosophy. We show our originators, execution partners, and customers how grateful we are for them, through words and actions. We constantly strive to build a platform where everyone wins.

Don’t stay in the business of a single product or service. Get into the business of building an ecosystem around your customer’s needs. Improve the lives of not just your customers but also your partners, employees, and other stakeholders.

Ask yourself, “How can we empower our users and partners?” Do what it takes. In return, they’ll empower you to achieve your goals.

3. They target quality before quantity.

It’s easy – common sense even – to chase numbers like sales, revenue, and costs. These numbers and other financial ratios are important. But they’re means to an end – to create value.

By turning numbers into an end in itself, businesses cause themselves a lot of harm. Leaders end up pushing people until they break, people resort to malpractices to achieving the numbers, and cultures get fraught with fraud and manipulation. (In 2018, 39 percent of CEOs were forced out of their positions due to ethical lapses.)

Companies that escape competition don’t just focus on next year’s top line and bottom line. They ask themselves questions like: How can we reduce employee turnover? How can we enhance customer experience? Thinking on these lines alone makes companies take actions different from the rest of the industry, and build a long-term competitive edge.

Here’s an example.

During a shareholder meeting, Jeff Bezos was quizzed about the company’s revenue growth. Bezos said he couldn’t remember the exact percentage. That’s rare for a CEO. When asked why, he said:

“I’m thinking a few years out. I’ve already forgotten those numbers.”

Wealth-creating companies obsess over improving their product and Customer Satisfaction scores, making inventory agile, reducing receivables, and more. While they work on these aspects, the numbers take care of themselves.

Focus on the quality of your business, your customer, and your people. Then the sales targets, receivables, inventory churn, and the stock price will take care of themselves.

Final Thoughts

Only dead fish go with the flow. You cannot go with the flow all the time. You must swim against the tide, change direction, and explore new parts of the stream.

In order to escape the competition, you must:

- Think long-term and even make short-term sacrifices.

- Build a philosophy to make your partners and customers win first.

- Improve the quality of your business before you chase quantity.

When you think short term, you fight with your competitors over the same piece of the pie. But when you think and act long-term, you expand the pie. And everyone – your customers, partners, society, and yourself – wins.