Almost everyone has heard about the recipe for making money in the stock market – buy great businesses and at a great price. However, no one ever specified “how”. There are many more questions including what do you mean by a great business, how do you know a business’ worth, and finally, how do we know whether a business is available at a bargain price. This is exactly where this book provides simple solutions. The following 3 steps can help you in investing in stocks for the long term.

Step 1: Identifying great businesses

Great businesses essentially have some differentiation or competitive advantage – unique products and services, distribution network, technological superiority, customers loyalty, efficient operations etc. But, identifying businesses with these advantages from the web of lakhs of businesses is undoubtedly an uphill task.

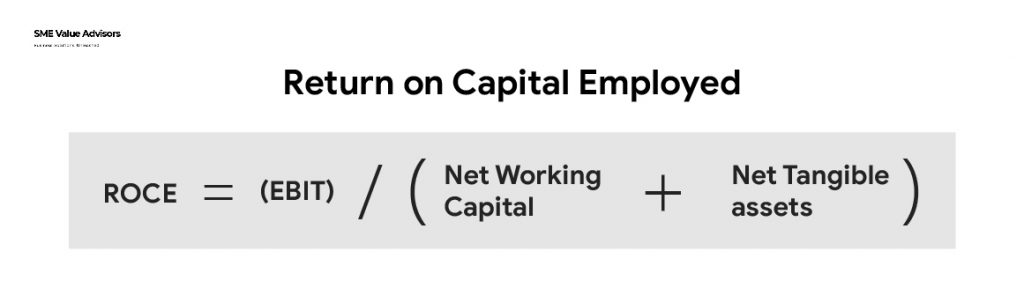

Joel consolidated these parameters into a simple numerical number – Return on Capital Employed (ROCE). The concept is quite simple – if a business is flourishing, it should be making a lot of money (This argument would not work for utilities, which are unique businesses but their output pricing is generally regulated) and that is what ROCE computes – the amount of money a business makes on each dollar of invested capital.

ROCE is computed as Earnings Before Interest and Taxes (EBIT)/(Net Working Capital + Net Tangible assets). EBIT compares firms by avoiding the impact of debt level (capital structuring decision of management) and differentiation in taxation. Also, EBIT being the earnings available to both the equity and debt providers is the right measure of earning for this formula.

Step 2: Is Mr Market offering that business at a great price?

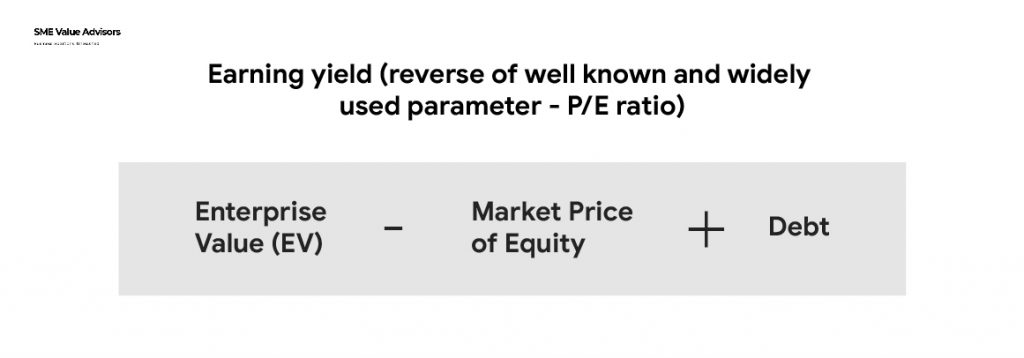

Great price here infers low price. After determining the ROCE, Joel recommends another parameter – Earning yield (reverse of well known and widely used parameter – P/E ratio). However, here, earnings are taken as EBIT (not net profits or earning per share) and the price is taken as Enterprise Value (EV) – Market Price of Equity + Debt.

The thought behind using EV is important because when you purchase shares of a business, equity is not a sufficient determinant parameter. You need to assume debt in the business. Hence, the true price of the business is EV and not just equity market value (market capitalization).

The latest EBIT, market capitalization and available balance sheet data are used for these computations.

Step 3: Investing and Divesting

Having identified two parameters – measures of great businesses and great prices, Joel provides a step-by-step procedure for investing/disinvesting as follows:

- Rank stocks in the market on both the criteria – ROCE (highest ROCE stock’s rank being 1) and Earning Yield (highest-earning yield stock’s rank is 1). Then, add the rankings.

- Sort the stocks based on this final rank (sum of ranks) from lowest to highest.

- Buy the lowest-ranked 20-30 stocks.

- Hold each of these stocks for one year.

- Replace the stocks with new stocks on ranking at the end of the year.

- Continue this process for several years regardless of results.

The book contains significant statistics from backtesting results of the above methodology. He has also elaborated on the limitations stating that formula may not work for a few months and years, but for the long term. Most investors tend to quit what does not work for a year or two or three. This is the ‘magic formula of investing.’

“To utilize the magic formula strategy successfully, you must understand only two basic concepts. First, buying good companies at bargain prices makes sense. On average, this is what the magic formula does. Second, it can take Mr Market several years to recognize a bargain. Therefore, the magic formula strategy requires patience.”

Joel has also set up a website – www.magicformulainvesting.com, where you can run this magic formula. However, right now, the universe of stocks here is limited to US stocks. However, he is attempting to expand that to include stocks worldwide.

Some additional thoughts about the book

- Spend time understanding a business’ worth. If we can find a business for a lot less than it is worth, buy it (margin of safety is critical). Also, if the business that we own is selling at a price much higher than it is worth, it may be good to sell that.

- Mr Market offers businesses at different prices at different times (based on its mood) but underlying businesses do not change so fast. We do not need to waste time thinking about why this happens. We need to think about how to use this information to make money.

- In the short term, Mr Market acts like a wildly emotional guy – buying businesses at inflated prices and selling businesses at depressed prices. In the long run, Mr Market is rational and reconciles with the valuations based on fundamentals.

- We may make no attempt to do the impossible – projecting the future. We should pay on the basis of what exists and what has been there.

- If a business is making lots of money (high ROCE), it would attract significant competition in a capitalist world and may gradually have moderate returns. Therefore, the durability of the competitive advantage is a question worth contemplating periodically.

- It is more probable to find mispriced stocks among smaller and mid-cap businesses for primarily two reasons – there are more stocks (bigger universe) and these businesses are less likely to be covered by analysts.

- In a leveraged world, traditional P/E (market cap/net profits) could be quite deceptive as we have to take on debt when we buy businesses. Think of buying a house by paying $20,000 and assuming a mortgage of $80,000 or paying the entire money $100,000 upfront. Both are the same from the buyers’ perspective.

- Analyze businesses at the firm level – the focus is never on the stock but on the value of business viz. Enterprise Value or EV (including debt).

Food for Thought

High ROCE may be viewed as businesses having good earnings relative to the historical cost of assets in their books (unequivocally, these are great businesses). And, high earning yields may be interpreted as businesses having good earnings relative to the price they are available at today (undoubtedly, are good prices). Now, the assumption is that relatively better ranking businesses would attract the attention of market participants and perform in the future. According to Joel, this set of stocks can be referred to as “Good companies at a relatively cheaper price” instead of calling “good companies at a bargain price.”

The author has actually combined the quantitative approach of investing by legendary investor Benjamin Graham (buy businesses which are cheap – low P/Es or low P/BVs etc.) and the qualitative approach of Warren Buffett (buy businesses which are good in addition to being cheap). However, while Buffett focuses on great businesses being available absolute cheap, Joel looks at great businesses being available cheap relative to other businesses. Further, this strategy suggests staying invested even if markets are at sizzling heights and believe they are at unsustainable levels. Over longer periods of ups and downs, probably, we would cover up and do well (at least, this is what Joel’s studies show).

An alternative approach to investing could be – identifying great businesses on a ROCE basis, research the top 30-40 stocks, identify 8-10 of them on a valuation basis and invest. This approach would obviously not encourage us to walk into the market when markets are very high and we see prices being higher than valuations (a fact, which the magic formula ignores). Here, the period of holdings could also be longer than one year based on the research work done. This is a deviation from what the magic formula suggests but, this may be a very sensible approach for those who are willing to put extra efforts in going a mile ahead to understand businesses and do valuations.

‘The Little Book That Beats The Market’ is an amazing piece of work by Joel Greenblatt, who is a hedge fund manager (runs Gotham Capital) and teaches an investment course at Columbia Business School. He has also authored You can be a Stock Market Genius. This book may be a little book but claims to carry a big message on identifying ‘great businesses available at a bargain price.’ This is definitely worth a read!